CPA, former S.D. legislator Wismer: Trump and Thune trying to weaken IRS to benefit wealthy donors

As a small-town CPA and tax preparer, I shouldn’t be taking time during tax season to stand up for the little guy, for honesty in a voluntary tax system, and for a decently funded Internal Revenue Service, but here I am, and that’s what I’m doing.

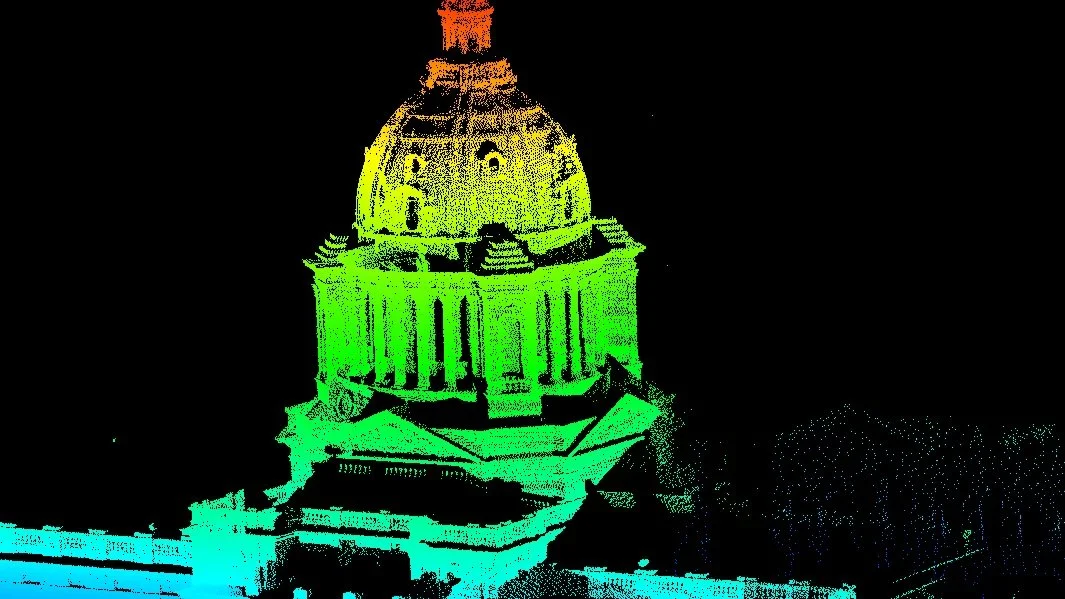

Senate Majority Leader John Thune is using his position to further undermine the capacity of the Internal Revenue Service (its Washington, D.C., headquarters is seen above in a public domain image posted on wikimedia commons) to collect taxes, by encouraging a multi-billion dollar budget cut. What an irresponsible use of power!

The IRS was chronically underfunded for years by GOP congressmen, who used it as a vote-buying punching bag, before a Biden infusion of dollars. An underfunded IRS leads to a lower level of voluntary compliance with tax laws and terrible taxpayer service.

Because of chronic underfunding, we now have a tax system where many high wealth or self-employed taxpayers pay what they feel they can get away with, while wage-earners pay on every dollar of their W-2 income, and honest people pay what the law says, without weighing the audit potential (weighing audit potential is illegal) or making use of an “ignorance is bliss” defense.

Many otherwise moral citizens use underpaying their taxes as a de-facto protest against how “the gubmint” spends their money, and see no conflict between their conduct and the Ten Commandments they espouse on other days. Why don’t those people take Matthew 22:21 (“Render unto Caesar the things which are Caesar’s …”) as literally as they do other parts of the Bible?

Is that a fair, honorable, equitable (oops! Can I use that word?) way to run a democracy? I don’t believe it is, and I’m disappointed our Sen. Thune doesn’t agree.

High dollar tax clients can afford to take trips to Washington to schmooze, complain about new IRS rules or audits, and lean on the congressmen they support with big campaign contributions to further incapacitate the IRS.

My clients must report what’s on their W-2s and 1099s and pay what is due. My small employers pay their payroll taxes in full and on-time. But they pay dearly in time and aggravation and sometimes dollars when I have to spend hours on the phone or write correspondence to solve errors. Then they’ll pay again when I have to stop erroneous levies, because the IRS is months if not years behind in processing correspondence.

During COVID, the IRS fell more years behind than they already were in processing returns and correspondence. I seldom have the patience to try calling the IRS. Either the call is disconnected after hour-long waits, or the IRS responder isn’t capable of resolving my issue. I am still dealing with issues from 2021 returns that the IRS lost or hasn’t processed yet. Some processes showed signs of improvements after the Biden funding, but they still have a long way to go to catch up.

In the meantime, Sen. Thune’s and the current president’s rhetoric encourages rampant underreporting of tax liability, especially among the self-employed and small and large businesses. Congressmen know that increased IRS funding means increased compliance and provides the best return on a dollar that the feds can get.

But they also know that their donors are the ones who will benefit if the IRS is weakened. So what does our senator do? He cherry-picks certain rich taxpayers/donors’ gripes to penalize the IRS budget.

Sen. Thune should be standing up for a competent, modernized IRS, able to respond to taxpayer questions, to promptly process correspondence and tax returns, and to be able to encourage voluntary compliance via a robust enforcement presence among both small and large taxpayers. Anything less is shifting the burden of paying for the government from high-income businessmen to the wage earner and the honest taxpayer.

It certainly is intellectually dishonest for a public servant who proclaims to be concerned about the federal public debt. A voluntary compliance tax system cannot survive when voluntary compliance is not seen as a smart business practice and there are no consequences for non-compliance. Where do Sen. Thune’s morals stand when it comes to encouraging voluntary tax compliance via an honestly funded Internal Revenue Service?

Honest taxpayers want to know.

Susan Wismer of Britton is a former state senator who served 10 years in the South Dakota Legislature. She was a member of either the Appropriations Committee or the Government Operations and Audit Committee for her entire tenure. Wismer is a certified public accountant. She and her sister Becky Weber have operated Britton Bookkeeping & Tax Service for 40 years.