Biden-haters like to play the inflation card but never mention that wage growth is more than holding its own

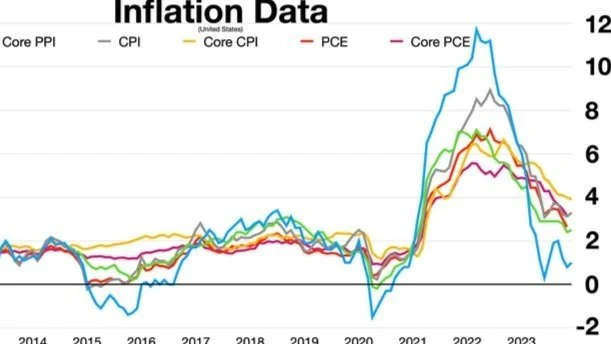

Republicans are bereft of economic data that can help them politically. Unemployment is historically low, the overall economy is steadily rising, stock prices are near all-time highs, and inflation (as graphically illustrated in the public domain image above, posted on wikimedia commons), after a post-covid runup that took it to a little over 9% a couple of years ago, is now a fraction of that at 3.5%, a number that itself is actually lower than the 62-year (1960-2022) average rate of 3.8%.

That they don’t have an economic argument of any substance this election year hasn’t deterred Republicans from trying to make a desperate, even hysterical, case against Biden’s economy.

That the case has no substance matters little to the GOP. The inflationary burst that occurred in 2021 and into 2022 was a function of covid-created circumstances, not Biden’s policies. An analysis from the Bureau of Labor Statistics concluded that “the combined effects of increased demand for durables and shortages caused by supply-chain disruptions were the main source of inflation in the second quarter of 2021. Both the direct and indirect effects of those supply-chain problems remained substantial through the end of 2022.”

Biden had nothing to do with a circumstance that was blowing out of control even as he was beginning his presidency.

Republicans know that, but they also know that this is politics, and those who scream loudest get the most attention. Ergo, the Republican fixation on blaming Biden for inflation.

Yes, prices have risen substantially since 2020. But Republicans, in their haste to pin the problem on Biden, remain mum about the other half of the story when it comes to inflation, that half being wages.

Fact is, for about a year-and-a-half now, wage increases in this country have been outpacing price increases. In March, the most recent figures I could find, wages increased at a 4.7% annualized rate while prices rose at a 3.5% rate.

Will the trend continue? I don’t have a crystal ball, but I do know that at these historically low unemployment numbers, employers will continue to scramble for workers. I doubt that wage increases will decelerate in that kind of environment.

For a local perspective, consider that there are “help wanted” signs all over the place here in Rapid City. Pennington and Minnehaha Counties, homes of Rapid City and Sioux Falls, respectively, had unemployment rates of 1.9% last March. Our state’s overall rate is 2.0%. The pressure is on South Dakota employers to keep wages competitive in this labor short market.

On a national scale, the U.S. Chamber of Commerce reports that the U.S. now has 8.5 million job openings, but only 6.5 million unemployed workers. Unless somebody has re-written the law of supply and demand, numbers like that suggest that wages can go only one way: up.

Then what about prices? We’ll get a hint Wednesday, May 15, when the April Consumer Price Index report comes out. Bloomberg reports that “economists are confident that the core US Consumer Price Index will be down.” Meanwhile, Kiplinger’s reports that the Cleveland Federal Reserve Bank thinks the index will be unchanged.

Me? I’m kind of “meh.” I traded stock options at the Chicago Board Options Exchange for more than a decade, then traded and brokered grain and livestock futures here in South Dakota for another ten years.

Some continuation of the recent trend of incremental upticks in inflation wouldn’t surprise me, but a return to the upside surge we saw in ‘21? Seems unlikely, considering that the external factors of those years aren’t part of the landscape.

As it turns out, this morning’s report on wholesale prices showed an April increase of 0.5%, higher than expected. Before panic sets in, though, note that March’s increase of 0.2% was also revised downward to -0.1%.

My conclusion, supported by history: Don’t sell the American economy short. The arc of the economy, despite its intermittent and sometimes painful blips, is one of growth. We’re righting ourselves in the fashion we always have, despite Republican claims that things are going badly.

The GOP needs continued price increases to support its election year narrative. It’s no wonder that Republicans are ignoring wage growth. The party has boxed itself into a corner so crowded with negativity that inflation has become its political ally.

John Tsitrian is a businessman and writer from the Black Hills. He was a weekly columnist for the Rapid City Journal for 20 years. His articles and commentary have also appeared in The Los Angeles Times, The Denver Post and The Omaha World-Herald. Tsitrian served in the Marines for three years (1966-69), including a 13-month tour of duty as a radioman in Vietnam. Reprint with permission.