Rapid City financial advisor Kahler: Have we redefined inflation? The gap between perception and economic reality

Recently, in hearing the term “inflation” used in the media and by consumers, it often seems as if two entirely different conversations are happening simultaneously. I finally have figured out this is exactly the case. My eyes were opened when I read a May 26 Axios article by Mike Allen, “The New Inflation.” Apparently, the definition of inflation has been changed by half of the country. In our world of “alternate facts,” this shouldn’t surprise me as much as it has.

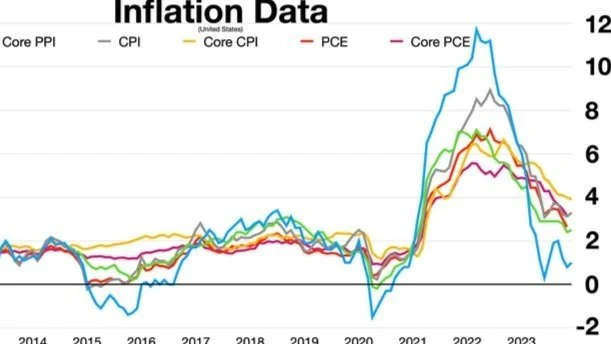

As an economic and finance professional, when I discuss inflation, I’m using its long-standard definition: the gradual loss of purchasing power, reflected in a broad rise in prices for goods and services. The Consumer Price Index, or CPI, calculated by the Bureau of Labor Statistics (as portrayed in the public domain graph above, posted on wikimedia commons), is designed to measure inflation as the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. It provides a snapshot of the rate at which prices are rising or falling on a year-over-year basis.

For the quarter-century between 1983 and 2008, the CPI remained relatively stable, generally aligning with the current figure of around 3.3%. This historical perspective is crucial for economists who argue that today’s inflation is not alarmingly high but within a normal range.

In that context, I have been frequently astonished by claims in the media, by right-leaning politicians, and by consumers that inflation is “high.” The reality, as measured by the CPI, simply does not support this assertion.

In his article, Allen emphasizes a critical shift in the public’s perception of inflation. While economists continue to rely on traditional metrics like the CPI, many Americans have started using “inflation” to mean “high prices.” The term has been commandeered and redefined to a point where the word “inflation” now means different things to different people.

When the average person mentions inflation today, they might be thinking of an overall increase in prices since a significant event, such as the COVID-19 pandemic. According to the Axios article, many people perceive inflation to be around 19.3%, reflecting the cumulative price increases over the past few years. In contrast, financial professionals and economists, adhering to the CPI, think of inflation as approximately 3.4% annually. This stark contrast is pivotal in understanding why there’s such a disconnect between public sentiment and official statistics.

This discrepancy between expert definitions and public perception mirrors other shifts in terminology in economic and political discourse. For example, I’ve written previously about the way the terms “socialism” and “capitalism” have also been subject to significant reinterpretation by the public. In popular usage, anti-socialism often translates to opposition against higher taxes and extensive government services, rather than a rejection of the traditional definition involving state ownership of the means of production. Similarly, criticisms of capitalism frequently target perceived abuses such as greed and corruption, rather than the fundamental principles of free markets and private ownership.

These shifts in meaning highlight a broader trend where complex economic concepts are distilled into simpler, more emotionally resonant terms that align with individual experiences and political agendas. There is a benefit to simplified language that can help consumers understand and engage with economic issues. Yet oversimplifying nuanced concepts to the point of inaccuracy only fosters miscommunication and misunderstanding.

Next time you hear someone use talking about “inflation,” I suggest asking yourself — or, if you can, asking them — what definition they are using. Do they mean “high prices,” or are they referring to the CPI measure? Knowing the context will help you inform the conversation and evaluate the accuracy and validity of their points and conclusions.

Rick Kahler, CFP, is a fee-only financial planner and financial therapist with a nationwide practice, Kahler Financial Group, based in Rapid City. His co-authored books include “Coupleship Inc.” and “The Financial Wisdom of Ebenezer Scrooge.”